Using Your HSA for Restorative Dentistry

This article is not meant to provide specific tax, financial, health/dental, or legal advice. Please speak to the appropriate party regarding personal questions and decisions.

There’s only a few weeks left in 2019, but that means there’s still time to take care of your teeth while making the most of your healthcare dollars.

Dental Insurance

First, let’s talk about dental insurance.

Dental insurance in the past was a wonderful benefit, while today it has limited value. Most policies have a maximum allowance of $1,000-$1,500 per year, while charging high monthly premiums. With this in mind, if you have unused dental benefits going into the last quarter of the year, it’s a shame to leave it on the table and not use it.

This is a great time of year to meet with Dr. Marsh and his well-educated team to schedule a consultation or continue with care. You may want to do this in order to maximize what you can get from insurance.

Health Savings Accounts (HSA)

Many people have health savings accounts or HSA’s. A health savings account is a tax-advantaged medical savings account. This means funds contributed to the account are not subject to federal income tax when deposited. If you are saving through an employer, you are setting aside money for health expenses later on.

So how does that work with dental?

The nice advantage of an HSA is that individuals can put aside money before it’s taxed which they can later use for dental care. If you need restorative work that could be done in a cosmetic manner, it’s a wonderful way to use that money.

In some cases, if you don’t use that money – and it’s put aside – it can be difficult to use the following year. If you put money away near the end of the year, don’t allow it to be wasted, as it’s your own money! It may or may not roll over to the next year, so it’s important to be aware and make use of this wonderful benefit.

Patient Case Studies

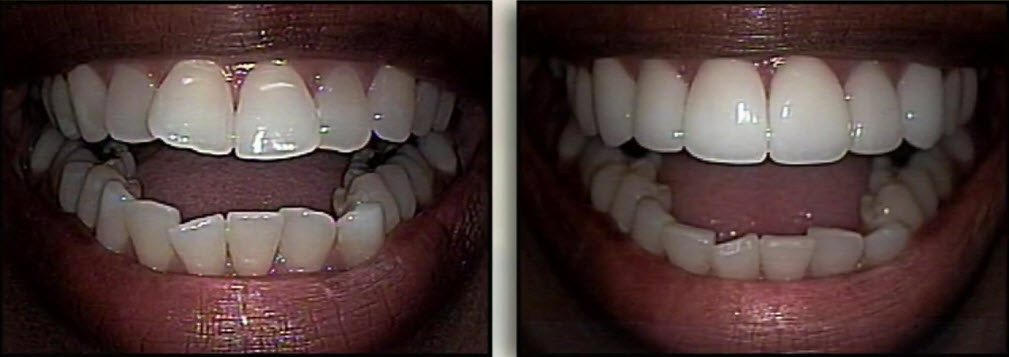

Oberlin Professor

We had a patient that came to us with dental insurance. She is a professor at Oberlin and a former guest of mine on the Golden Opportunity show. She never liked the way she smiled, yet her profession requires here to be interacting with people all of the time.

We did some laser gum contouring, using what’s called a diode laser. (The procedure is quite painless!). We then placed four veneers.

This patient had a set amount of dollars to use before the end of the year, so we used it for her procedure. She was thrilled with her result and the following year, we did more work, extending her treatment to her posterior teeth.

Cleveland Physician

A physician in Cleveland needed to have dental work done. He had some advanced periodontal disease that required the removal of a couple of teeth. Knowing that he would require extensive treatment, the doctor established an HSA account which he fully funded.

We looked at options, and decided on porcelain bridgework because he was not a candidate for dental implants. The bridges look beautiful, they’re permanent, and he and his wife are thrilled with his appearance; they both commented that he smiles more and is now more dedicated to taking care of his teeth!

[button link=”/contact-us/” color=”red” size=”large” stretch=”” type=”” shape=”square” target=”_self” title=”” gradient_colors=”|” gradient_hover_colors=”|” accent_color=”” accent_hover_color=”” bevel_color=”” border_width=”2px” icon=”” icon_divider=”yes” icon_position=”left” modal=”” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” alignment=”left” class=”” id=”ctabutton”]Schedule Your Free Consultation Now! »[/button]

Government Employee

Another patient was a government employee who never liked the way her teeth looked. We started work in year one, did some reshaping on her lower teeth and used porcelain crowns to give her a beautiful smile. The following year, she opted to focus on her lower teeth with porcelain veneers, using her dental benefits and HSA account.

Local Teacher

A patient in her 60’s said, “listen, I want my teeth done. I want them to look good. Having been quite sick this year I’ve had a lot of medical expenses, so if I get my teeth taken care of now it can be added to my deductions.” So she added, “I’ve been waiting, but let’s do it now.”

She had a lot of problems with her teeth, as they were decayed and quite worn down. Her sister brought her in and said, “She’s worked as a teacher for all these years. She hasn’t used all her insurance; she’s had money put away, and she deserves a smile she can be proud of and teeth that she can chew with.

Dentally, the upper teeth were too badly broken down and unsupported, so an upper denture was placed that she was extremely comfortable with. In the lower arch, we did some reshaping, gum contouring, and applied porcelain veneers. Her sister said that she loves her new teeth and smile and is much more comfortable and proud!

So there are many wonderful financial reasons to get your dentistry done, whether it’s insurance, HSA, or a tax-related benefit – in addition to the both the function and form of healthy teeth. In either case, this is your time of year to do it!

[button link=”/contact-us/” color=”red” size=”large” stretch=”” type=”” shape=”square” target=”_self” title=”” gradient_colors=”|” gradient_hover_colors=”|” accent_color=”” accent_hover_color=”” bevel_color=”” border_width=”2px” icon=”” icon_divider=”yes” icon_position=”left” modal=”” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” alignment=”left” class=”” id=”ctabutton”]Schedule Your Free Consultation Now! »[/button]

For over 40 years, Dr. Steve Marsh has been improving smiles in Cleveland and Northeast Ohio. Contact us now to discuss your dream smile and schedule an appointment!

Leave A Comment